how does retirement annuity reduce tax

Take Advantage Of Retirement Savings With One Of The Worlds Most Ethical Companies. Reduce RMDs with a Qualified Longevity Annuity Contract QLAC A qualified longevity annuity contract QLAC is a deferred annuity contract designed to keep you from.

Tax Deferral How Do Tax Deferred Products Work

For many investors in fixed annuities it can be difficult to increase income while minimizing taxation.

. Therefore of each payment received 82 is not subject to tax for the next 15 years and this makes immediate annuities a powerful choice for reducing taxes. Ad Find Out Why Tax Diversification is Important. With Merrill Explore 7 Priorities That May Matter Most To You.

It also includes any interest income above R23 400 and any net rental income. Even though fixed annuities do provide safety and greater rates than most. Similar to a ROTH IRA you can pull money out of.

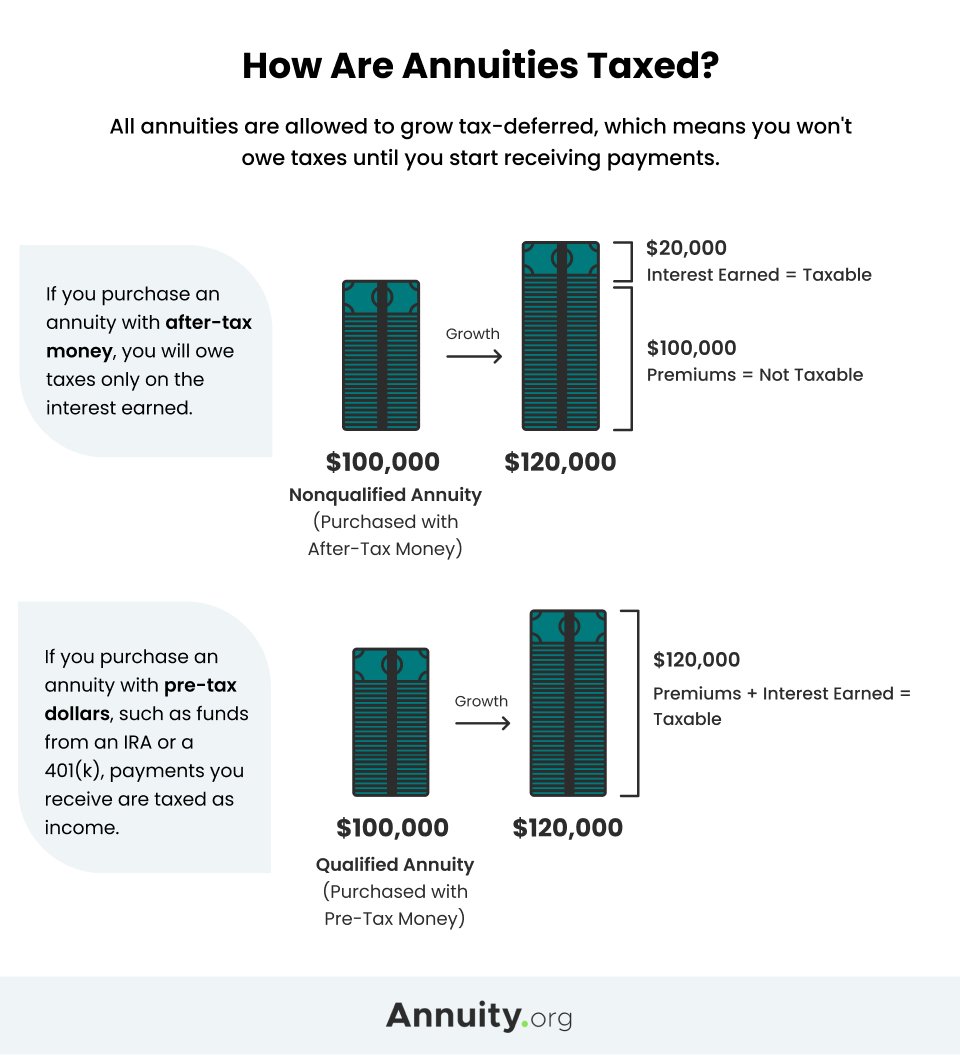

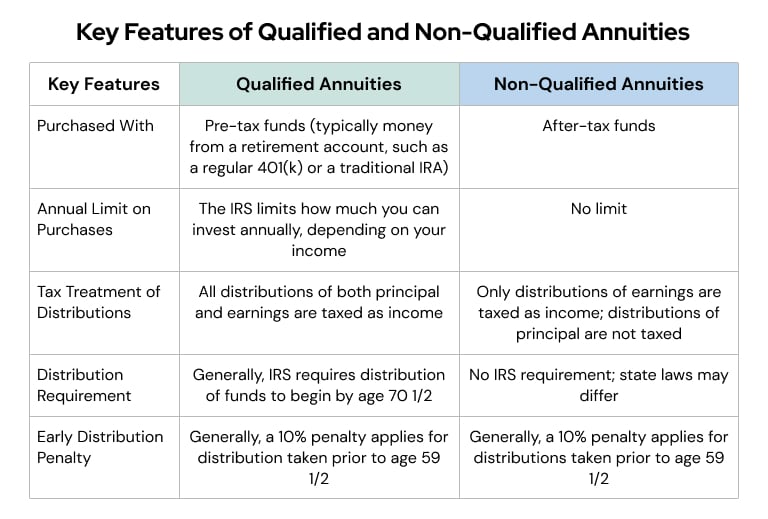

Annuities are taxed at the time of withdrawal regardless of the. Tax-deferred annuities allow taxpayers to reduce their taxable income by contributing pre-tax funds to an annuity premium. Ad You Can Manage Your Own IRA Or Let TIAAs Investment Professionals Help You.

In turn all retirement income will be tax-free. Based on Section 72 of the IRC Internal Revenue Code funds that are inside of an annuity can grow tax-deferred so there is no tax due on this gain that takes place inside of the account. You can defer paying income tax on up to 6000 that you deposit in an individual retirement account.

If your company does not have a retirement fund all your income will be non-pensionable. If you dont youre not alone. A worker in the 24 tax bracket who maxes out this account will reduce.

In other words a retiree could have an extra 4 for every 100 of income if certain tax strategies are. Ad Learn More about How Annuities Work from Fidelity. So you can claim.

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. In fact most retirees and those who are. If you receive pension or annuity payments before age 59½ you may be subject to an additional 10 tax on early distributions unless the distribution qualifies for an exception.

Ten Ways to Save Tax with a Retirement Annuity 1. If you fall in the 45. Utilizing a Roth IRA Annuity will pay an owner a tax-free income for life.

Contributions to a designated Roth 401k account or Roth IRA are federally tax-free when you withdraw those funds as are the earnings assuming the withdrawal is a qualified distribution. Contributions are tax-deductible up to a certain maximum eg. Do you know how you can reduce or even eliminate taxes on your Social Security using an annuity.

Doing so can boost retirement income by more than 4 they found. With Merrill Explore 7 Priorities That May Matter Most To You. Ad What Are Your Priorities.

Discover Which Retirement Options Align with Your Financial Needs. Ad What Are Your Priorities. Ad This must-read guide can help make your retirement dreams a reality.

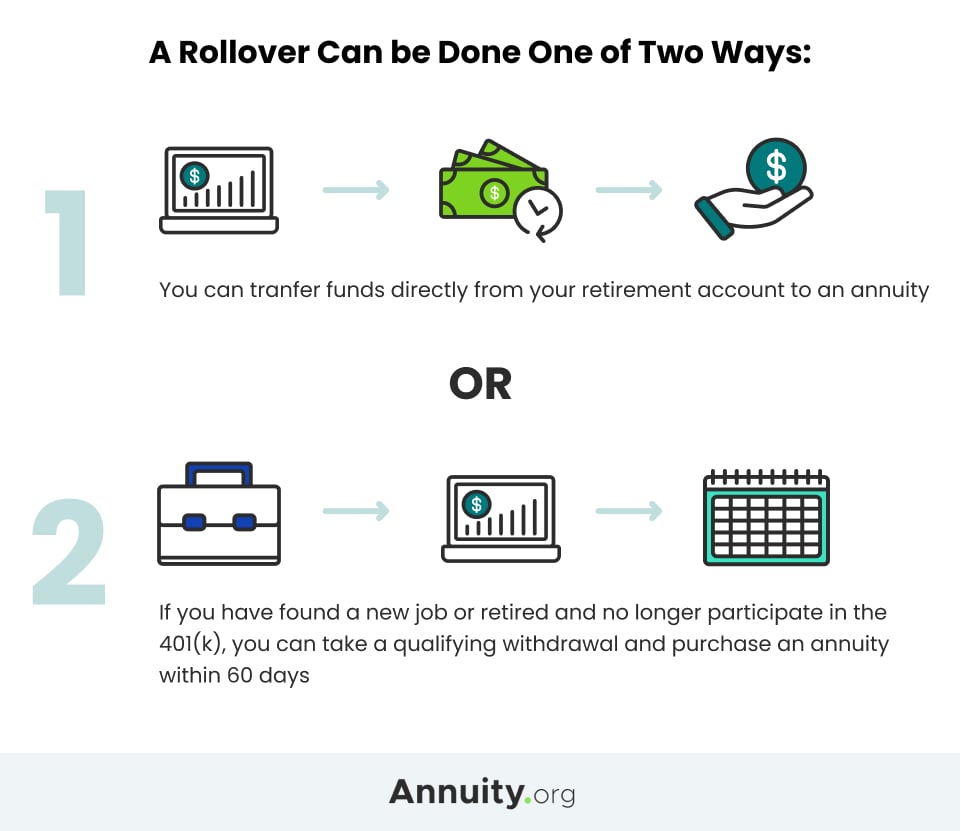

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

Tax Sale Tax Experts Tax Filing Online Company Tax Tax Income Tax Claim Tax Schedule Teaching Money Financial Literacy Lessons Teaching Economics

Retirement Account Distribution Strategies Retirement Strategies Retirement Planning Finance Retirement Accounts

A Roth Annuity Can Create Tax Free Lifetime Income During Retirement Or Reduce Your Risk While Saving For Retir Saving For Retirement Retirement Income Annuity

Tax Free Savings Account Vs Retirement Annuity Which Is Better

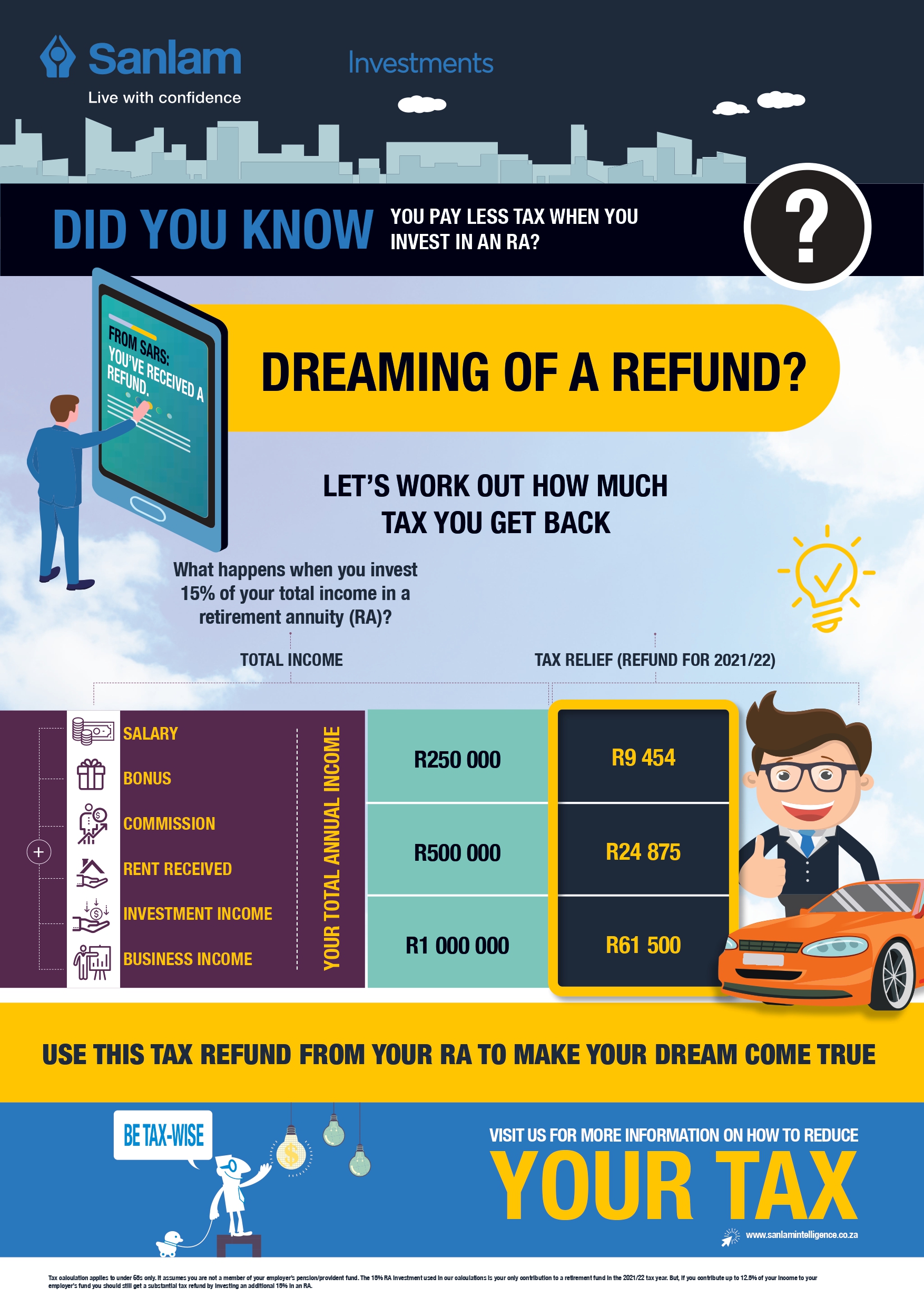

Retirement Annuities Is The Tax Refund Worth It

Annuity Taxation How Various Annuities Are Taxed

Annuity Taxation How Various Annuities Are Taxed

How Do Annuities Work Wealthfit Annuity Annuity Retirement Saving For Retirement

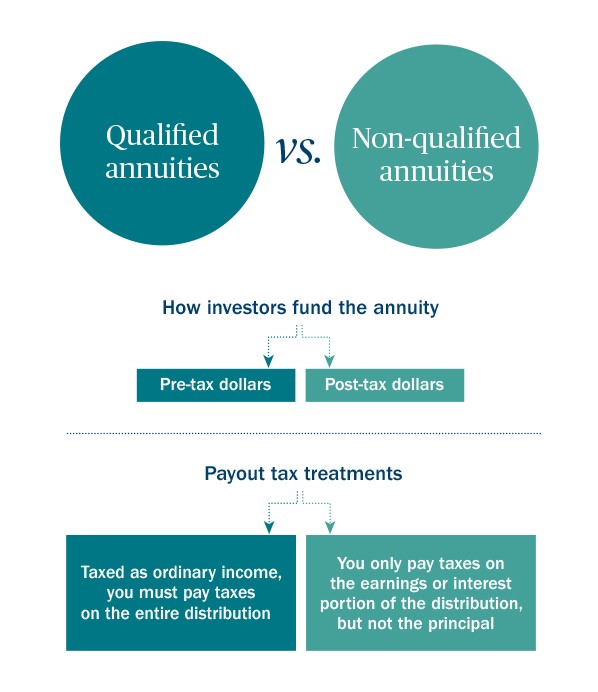

Qualified Vs Non Qualified Annuities Taxes Rmd Retireguide

Retirement Annuities Is The Tax Refund Worth It Sanlam Intelligence Retail

Income Tax Deductions Fy 2019 2020 Tax Deductions List Income Tax Income Tax Preparation

Retirement Annuity Ra Or Tax Free Savings Account Tfsa Which Is Better Sanlam Intelligence Retail

Opinion Smart Withdrawals Can Reduce Taxes Extend Your Nest Egg In Retirement Marketwatch In 2021 Investing For Retirement Retirement Saving For Retirement

Annuity Annuity Retirement Cheating

Section 162 Executive Bonus Plan And It S Benefits How To Plan Life Insurance Policy Permanent Life Insurance

Taxation Of Annuities Ameriprise Financial

Can I Retire At 60 With 1 5 Million Retirement Insurance Sales Retirement Planning

What Will You Do For A Regular Monthly Income When You Retire Annuities Provide One Possible Answer But They Re Not For Ever Annuity Income Retirement Income